Many investors often find themselves pondering a critical question: Should I hold my stocks for the short term or commit for the long haul? In my experience—and in alignment with some of the greatest minds in investing—the answer is resoundingly in favor of the long term.

Warren Buffett, widely regarded as one of the most successful investors of all time, has famously stated that his favorite holding period is “forever.” He’s not exaggerating. When you own a stake in a business that steadily earns profits year after year, and you have no immediate need for cash, there is little wisdom in parting with that investment for a modest gain.

Peter Lynch, the legendary manager of Fidelity’s Magellan Fund and author of One Up on Wall Street, echoed a similar sentiment when he warned against the common mistake of "pulling out the flowers and watering the weeds." Too often, investors sell their winning stocks too early while holding onto underperforming ones, a habit that undermines long-term returns.

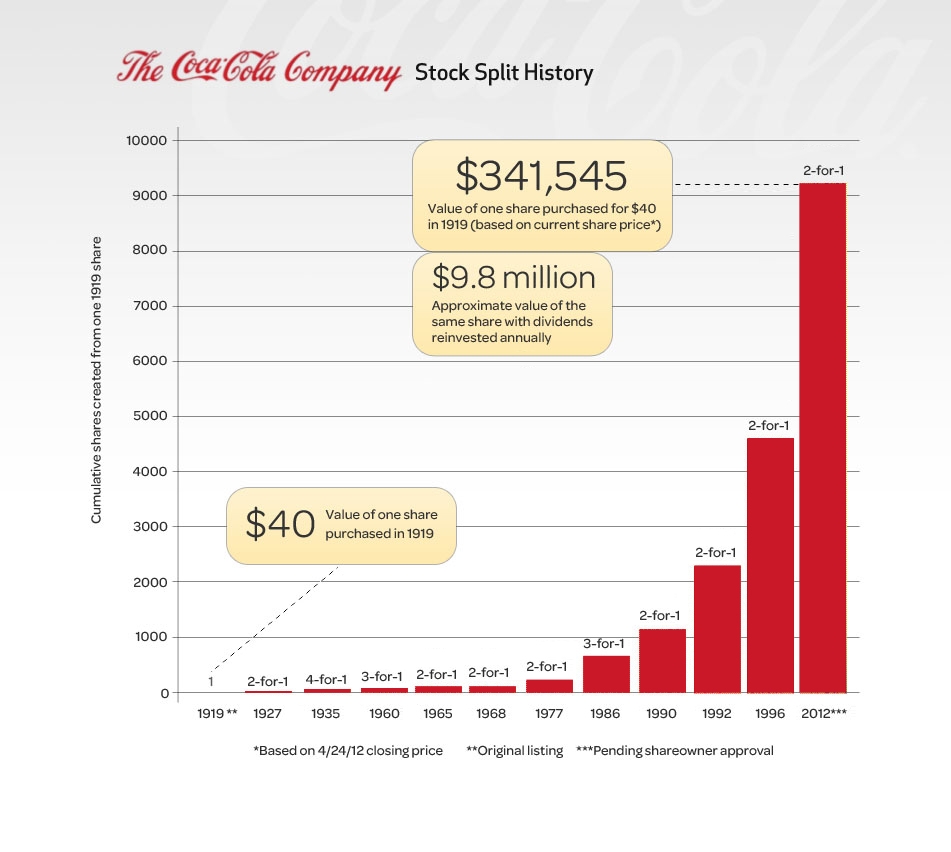

To illustrate the power of patience, consider the story of The Coca-Cola Company. In 1919, Coca-Cola made its initial public offering at $40 per share. Suppose you had purchased a single share and reinvested all the dividends along the way. That humble $40 investment would now be worth an astonishing $9.8 million. No, that is not a typographical error. It is a testament to what can happen when you identify a strong business—and simply hold on.

This example serves as a vivid reminder that time is the most powerful ally of a disciplined investor.

Image courtesy of JoshuaKennon.com

Image courtesy of JoshuaKennon.com